Digital Lending in Africa

With 7 out of 10 customers who own bank accounts lacking access to credit from traditional institutions like banks, digital lending plays an integral role in closing up this credit gap. Providing quick and secure credit to customers allows them to finance their ever-growing needs, more easily. Small business owners can now get capital for their businesses, and households can conveniently pay for a child’s education and sort out other bills.

Besides making credit more accessible to people, digital lenders also ensure that customers have a seamless experience when they want to borrow. They do this by building digital channels like mobile and web apps to make the application, disbursement, and repayment of loans seamless. Compared to filling out lengthy application forms and possibly visiting offices physically, this enables users to apply for loans online in minutes, get their approved loan amount, and repay at the due date all within a loan app or website.

Digital lenders also use various kinds of data to check a borrower’s eligibility for loans. This data can be collected from different sources like bank statements, e-commerce transactions, bill payments history, or credit bureaus, and then analyzed to predict a borrower’s credit repayment history or their capacity to repay a loan. This data can also be leveraged to automate digital lenders’ underwriting and credit scoring processes.

What does the digital lending process look like?

Today with a phone and internet connection, individuals and small business owners can access quick, collateral-free loans from digital lenders. The ease of access to loans and credit through mobile applications and the convenience experienced is the biggest appeal of digital lending for customers.

When you sign up on most digital lending apps or websites, you are required to enter your account and identity information (BVN, NIN, account number, residential address, date of birth, full name, utility bills, etc) as part of the onboarding and KYC process. Then, you have to share your bank statement with the lender to prove your creditworthiness, and if the lender considers you eligible for a loan, your loan application is immediately approved and the funds are disbursed to your account.

While digital lending has created better access to consumer credit, it is also a net positive for the economy. When financial barriers to accessing credit are lowered, consumers can buy more goods to meet their individual needs which increases their purchasing power and eventually leads to an improved standard of living. They could even start small businesses to increase their earning power and become more self-sufficient, altogether this helps to lower unemployment rates, reduce poverty among low-income earners, and boost the economy.

In addition, access to affordable credit has allowed customers to borrow and spend more, and businesses to borrow and invest more. This rise in consumption and investments leads to a growth in income and profit and benefits the overall economy as well.

What are the challenges experienced with the current digital lending process?

Lack of access to financial data

When a user applies for a loan, they need to share their transaction data with lenders so they can determine their eligibility for a loan. One of the ways digital lenders can access this data is through credit bureaus, but when 70% of borrowers in Africa do not have a credit history, it is difficult to assess their creditworthiness and qualify them for loans. However, in cases where a user has data available at the credit bureaus, the service is usually too expensive for lenders to access.

The lack of access to customers’ transaction data can also be tied to high rates of defaults on loans. When lenders can’t verify borrowers’ income or transaction history to determine their creditworthiness, they could offer loans to users who do not have the capacity to repay. In other cases, they could give users lower loan amounts than what they applied for, even if their income levels —which cannot be easily verified—qualify them for higher amounts.

Sometimes, digital lenders also have to rely on users' self-reported financial data which aren’t always accurate, in order to determine users’ eligibility for loans. This makes the underwriting process more cumbersome and forces lenders to make uninformed lending decisions.

Limitations with identity verification

As part of the Know Your Customers (KYC) process, lenders require users to submit their Bank identity information (depending on what’s applicable in the operating country) to validate their identity. While this tedious onboarding process helps digital lenders verify that the details supplied by the borrower match what is on their financial account, oftentimes, they are unable to check that these details belong to the user applying for the loan.

In the event that a user’s details are compromised and their identity is stolen by someone, their account details could be used to apply for multiple loans with no intention of paying them back. This leaves the user with huge debts to repay and could make it much harder for them to borrow money from other lenders when they need them.

Inadequate continuous visibility into users' financial patterns

Lenders often don’t get continuous visibility into users’ finance patterns. This is because they only see users’ financial statements once, usually at the loan application stage. They also can’t access their up-to-date transactions to better identify and understand changes in users’ spending and cash flow patterns.

Being able to get continuous financial visibility to analyze users’ creditworthiness can help lenders to make more informed credit decisions. For example, if a user’s transaction history indicates that they are spending more than they usually earn or make late payments, you could reassess their credit limits and possibly lend less to reduce the risk of default. You could also assign higher loan amounts if you notice an increase in their income level.

Mono’s role in scaling digital lending in Africa

Open Banking has the potential to resolve the challenges in lending that both African lenders and borrowers face. An Open Banking platform like Mono provides lending businesses across Africa with access to the infrastructure and tools they need to leverage more data points, to understand their users better and make informed credit decisions. We will explore them below.

Secure and reliable access to users' financial data

Ideally, whichever process you use to access your customers’ financial statements should be secure, reliable, and simple to use. Here’s why.

Secure: The statements shared by users should be authenticated to ensure that it belongs to them and isn’t falsified. Users should also be able to securely share their statements with lenders without their details or personal data being compromised.

Reliable: The transaction data you collect from users has to be 100% accurate, complete, and up-to-date. Relying on quality data gives you a full picture of the user’s spending pattern, and helps you make data-driven decisions and offer more personalized loans.

Simple to use: To speed up the application process, users should be able to share their financial statements in a few clicks and lenders can receive them instantly without bad user experience getting in the way.

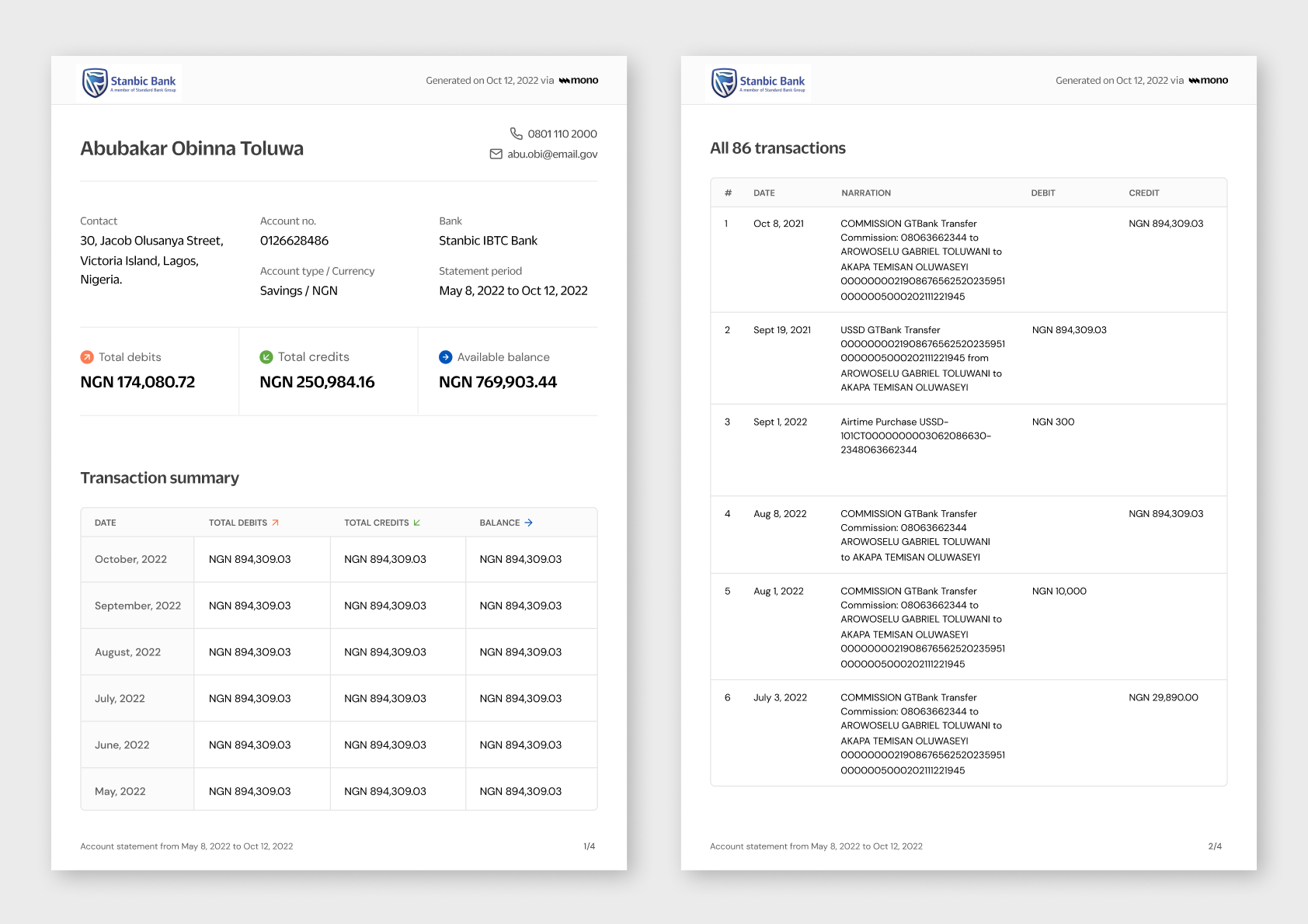

Leveraging on Open Banking APIs, Mono Statement Pages allows digital lenders to securely collect bank statements directly from a user’s bank account without writing a line of code. Digital lenders can access customers’ financial data (transactions, income, and balances) from over 30 financial institutions across 4 countries in Africa.  The process is simple, the user is asked to connect their financial account using Mono, this helps to authenticate ownership of their account and gives Mono the permission to retrieve their verified, real-time statements directly from their bank, and securely share them with the lender. This enables lenders to instantly verify users’ income and transactions with real-time data, directly from their bank account and offer secure loans.

The process is simple, the user is asked to connect their financial account using Mono, this helps to authenticate ownership of their account and gives Mono the permission to retrieve their verified, real-time statements directly from their bank, and securely share them with the lender. This enables lenders to instantly verify users’ income and transactions with real-time data, directly from their bank account and offer secure loans.

Mono also encrypts users' login details to keep them secure during and after the account linking process on Mono, and also ensures that it isn’t visible to the lender they shared their statement with.

Secure identity verification for users

The Mono Connect product enables lenders to securely validate users’ identity and account information without having to go through the cumbersome process of manually validating this information.

With Mono, the user is able to connect their financial account to the loan app or website and share their Bank identity information (depending on what’s applicable in the operating country) with the digital lender. This allows the lender to access their identity information directly from the bank and check that it matches the details the user has provided.

Also, this makes identity validation more seamless for the lender and speeds up the customer onboarding process so the borrower can conveniently access the credit they need.

Better credit scoring processes

To increase the speed of credit-risk decisioning, Mono provides lenders with rich and detailed data points to make informed loan decisions. This data can also be aggregated to build credit scoring and loan prediction default models that automate the underwriting process and help lenders accurately understand users’ spending patterns and determine their capacity to repay loans.

However, because this data comes in uncategorized formats, each transaction has to be sorted into categories by the lender to answer questions like:

What does the user spend most of his income on?

Has the user previously borrowed money from other lenders?

What merchants does the user spend their income on?

Is the user repaying loans collected from other lenders?

To make sense of this data in seconds, the Mono Transaction Metadata feature automatically classifies transactions into categories such as Transfers, Airtime, Loan repayment, Bank charges, ATM withdrawals, VAT, etc, and identifies the merchant used for these services based on their industry category. This allows lenders to retrieve detailed insights on customers’ transactions and determine the purpose of each credit and debit made on a customer's financial account.

Informed with these categorized data, your credit scoring model can then automatically compute what loan amount should be approved, what the interest rate for the loan amount should be (this ensures that appropriate interest rates are given for specific loan amounts), what credit limit should be assigned to the borrower, and if the customer has the capacity to repay their loans. Overall, this helps lenders make more accurate loan decisions, leading to increased loan approvals and higher repayment rates.

Continuous visibility into users' financial status

With the Mono data sync feature, lenders can access new data (transactions, statements, and balances) from users’ financial accounts in real-time. This happens without requiring the user to submit their recent bank statements each time the lender needs to view their current transaction history.

Being able to check users’ cash flow on an ongoing basis provides lenders with visibility into their financial health, so they make informed loan decisions. This could help them to review a user’s credit limit to either lend more or lend less to reduce the risk of non-performing loans. They are also able to quickly predict late repayment issues when a user’s financial situation changes and take proactive action to prevent business losses.

Scaling lending with Mono

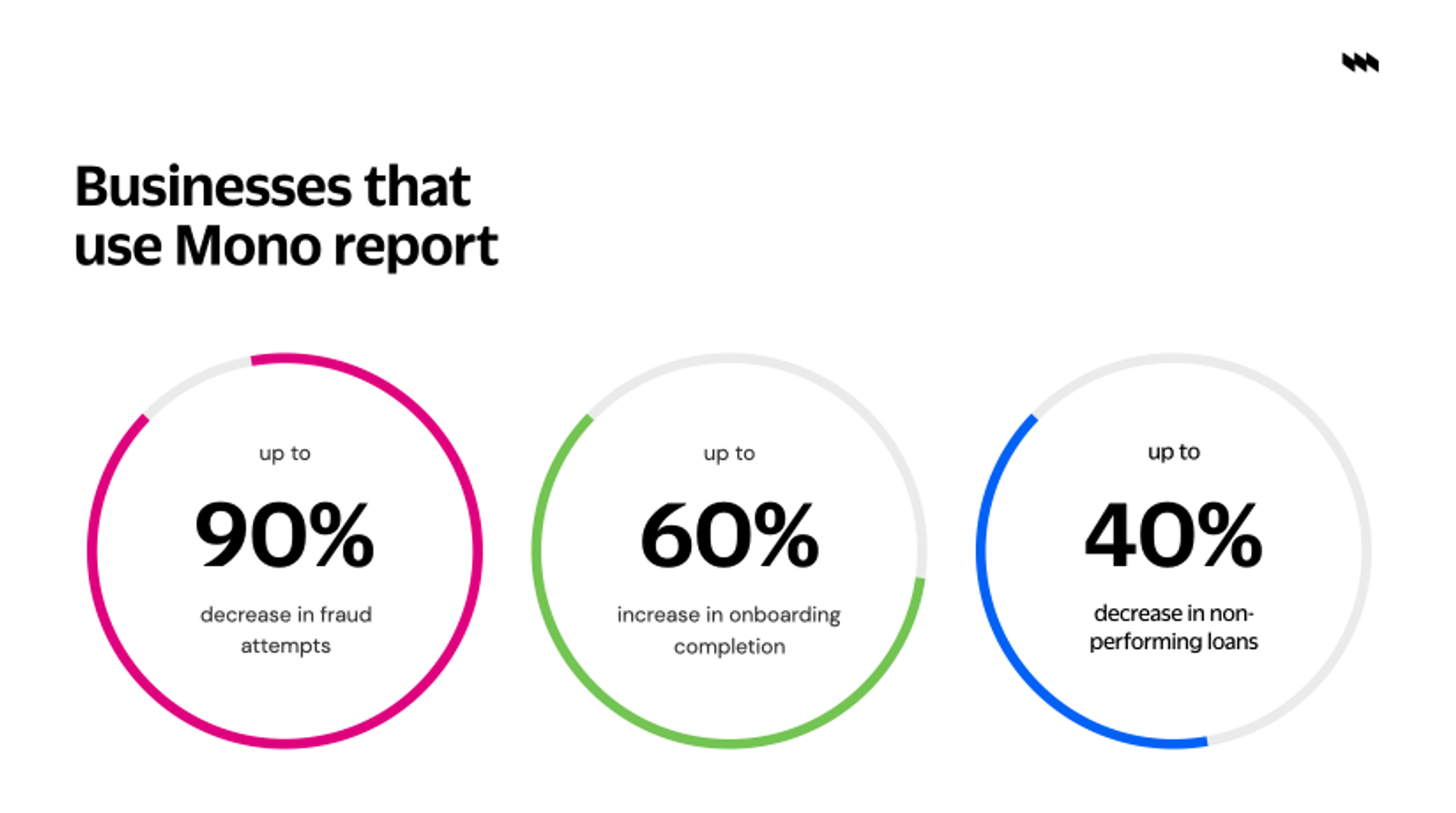

Mono has been powering hundreds of ambitious lending businesses in Africa, enabling them to make credit available to individuals and small businesses for various purposes. Some indicators of success that these lenders have experienced since integrating with Mono and leveraging Mono’s APIs include:

Faster loan approvals

Improvements in the underwriting process

Reduction in non-performing loan rates

Want to scale your digital lending process?

For digital lenders who are looking to scale their business and empower their users with a hassle-free lending experience, we are here to help. You can reach out to our Sales team via email at sales@mono.co, or fill out this contact form letting us know more about your specific business use case.