The first half of 2025 was an exciting one at Mono. We rolled out new features and shipped updates that help businesses and developers in Africa continue building delightful financial experiences for their customers.

As we kick off the second stretch of the year, we wanted to share a quick look back at what we’ve been up to. Catch up on everything.

January

We reflected on 2024, and in this video, we shared everything Mono was up to with you.

Our first update to the Mono Data Enrichment API went live. We added the Job Tracker endpoint to enable businesses to track the status of API requests in real-time when they call any of the data enrichment endpoints.

We created a 4-part video series for this year’s Data Privacy Day, sharing tips on how to protect your data online. If you haven’t seen them, check them out here.

We shared a detailed comparison between Cards and Direct Debit, and which method works best for collecting recurring payments.

February

The Pre-Debit notification feature was implemented on Mono Direct Debit. This helps insurance or savings businesses that collect regular commitments from users to send automatic reminders to customers to fund their accounts, reducing the chance of missed payments. Enable this feature here.

If you still don’t know how Mono DirectPay Pages work for accepting secure, one-time payments without coding, we made a quick video tutorial to show you.

We wrote a guide on how Standing Orders differ from Direct Debit and the advantages they offer for businesses that want to build a smoother recurring payment collection flow. You can read it here.

March

We spotlighted Sycamore, one of our earliest users of Mono Direct Debit in a customer story. They shared how switching from cards to Mono Direct Debit helped them automate their loan recovery process and increase loan disbursements by 50%.

We shared an article on how the Mono DirectPay product is different from Mono Direct Debit, and how you can use them to either accept one-off or recurring payments from customers.

April

A Balance Inquiry feature was added to Mono Direct Debit. This enables businesses to check customers’ account balances in real-time, to ensure that they have enough funds to cover a debit before the transaction is initiated.

To see how payroll companies can use Direct Debit to enable their customers to automatically make payroll deposits and ensure employees’ salaries are disbursed on scheduled dates, we shared a simple article on our blog.

If you collect recurring payments from customers and are curious about how secure Mono Direct Debit is, compared to cards, we put together a guide explaining the differences.

May

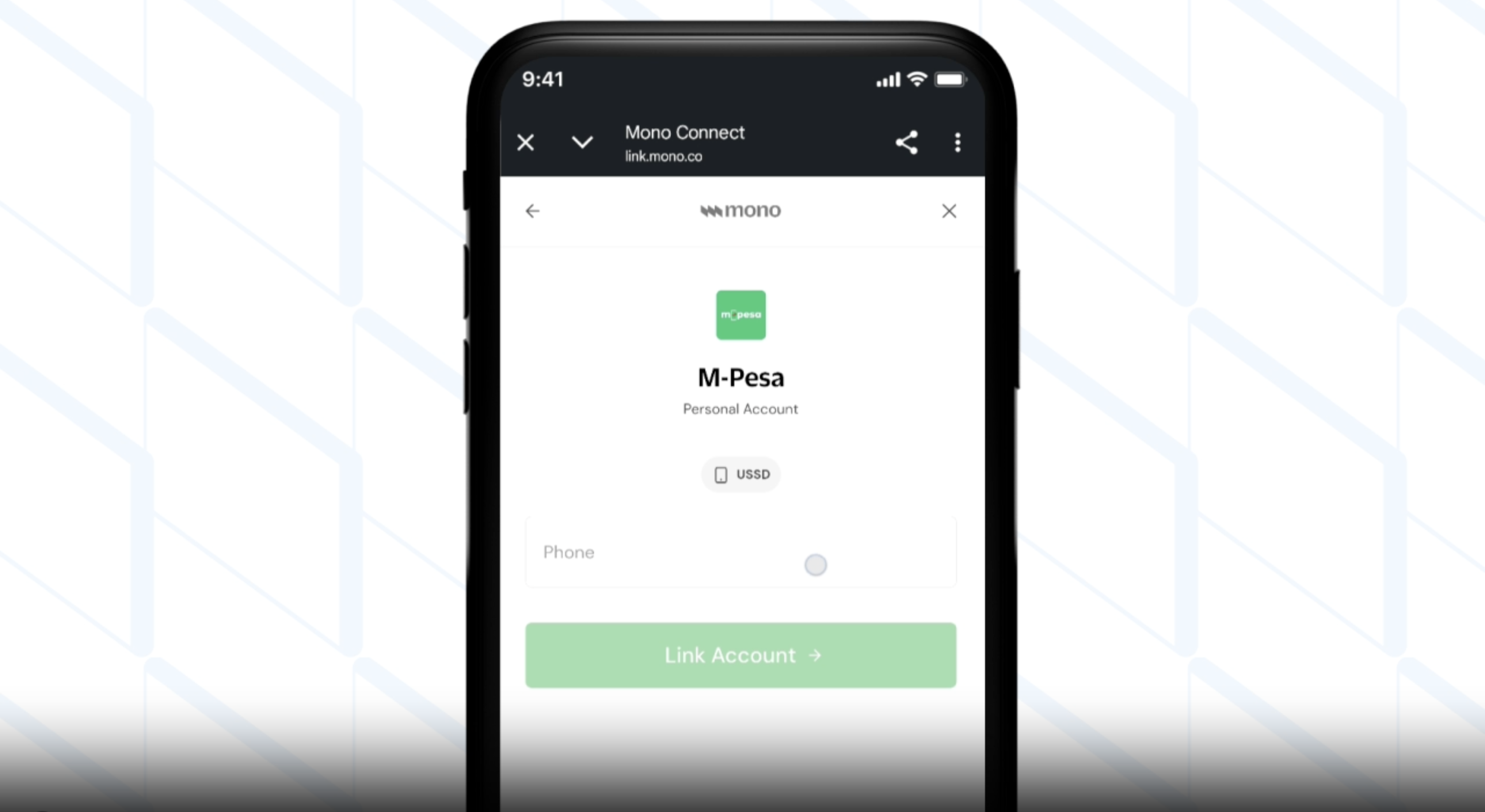

We added the M-Pesa connection back on the widget, enabling your Kenyan users to securely link their M-Pesa accounts using the new USSD authentication method and share their financial data with your business. Watch how it works.

We also updated the Mono Telco API. This allows you to securely access users’ up-to-date balances and transaction data from MTN and Airtel telco connections using our Real-Time API.

If missed recurring payments are a consistent problem for your savings or investment business, we shared how Direct Debit can automate the account funding experience for your customers, helping them top up their savings and investment plans on time.

For Insurance services that collect insurance premiums at scheduled intervals, we also have a detailed guide on how Direct Debit can improve their collections and reduce missed payments.

June

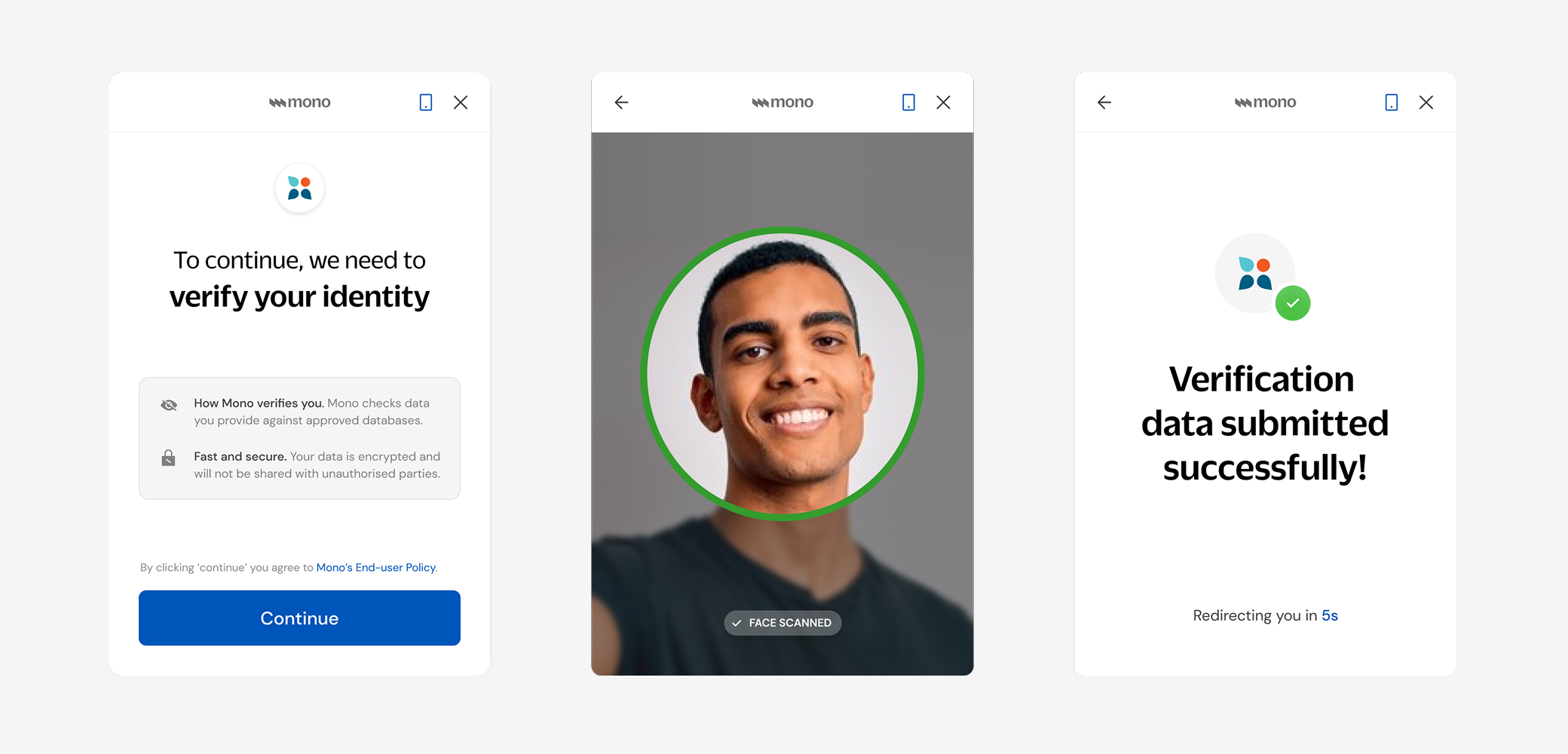

We’ve been working on Mono Prove, an exciting, new tokenised identity verification product that helps businesses onboard customers faster and more securely. To be one of our early users and experience the Mono Prove product, please fill out this form.

We wrote about how Direct Debit reduces the chances of subscription payments failing by automatically processing payments from customers’ accounts, which do not expire or get outdated. Read how Direct Debit ensures this.

The third edition of the Mono Summer Internship programme opened up in June. We're excited to be doing this for the third time and looking forward to helping young talents build solid experience in tech.