Nearly 18 months ago, we launched the Statements endpoint and Statement Pages, two vital components of the Mono Connect product, to empower businesses across Africa to easily access financial statements from their customers in PDF and JSON formats.

Since launch, we’ve helped over 1 million end-users in Africa who use digital financial services to securely share their bank statements from 45+ financial institutions with companies of all sizes, from fintech startups like Float to neo-banks like Renmoney and Carbon

These Mono-generated financial statements in both formats enable businesses that use Mono to assess customer transaction patterns and cash flow, understand their customers better, make quicker underwriting decisions for lending, and offer them other financial data-optimized services.

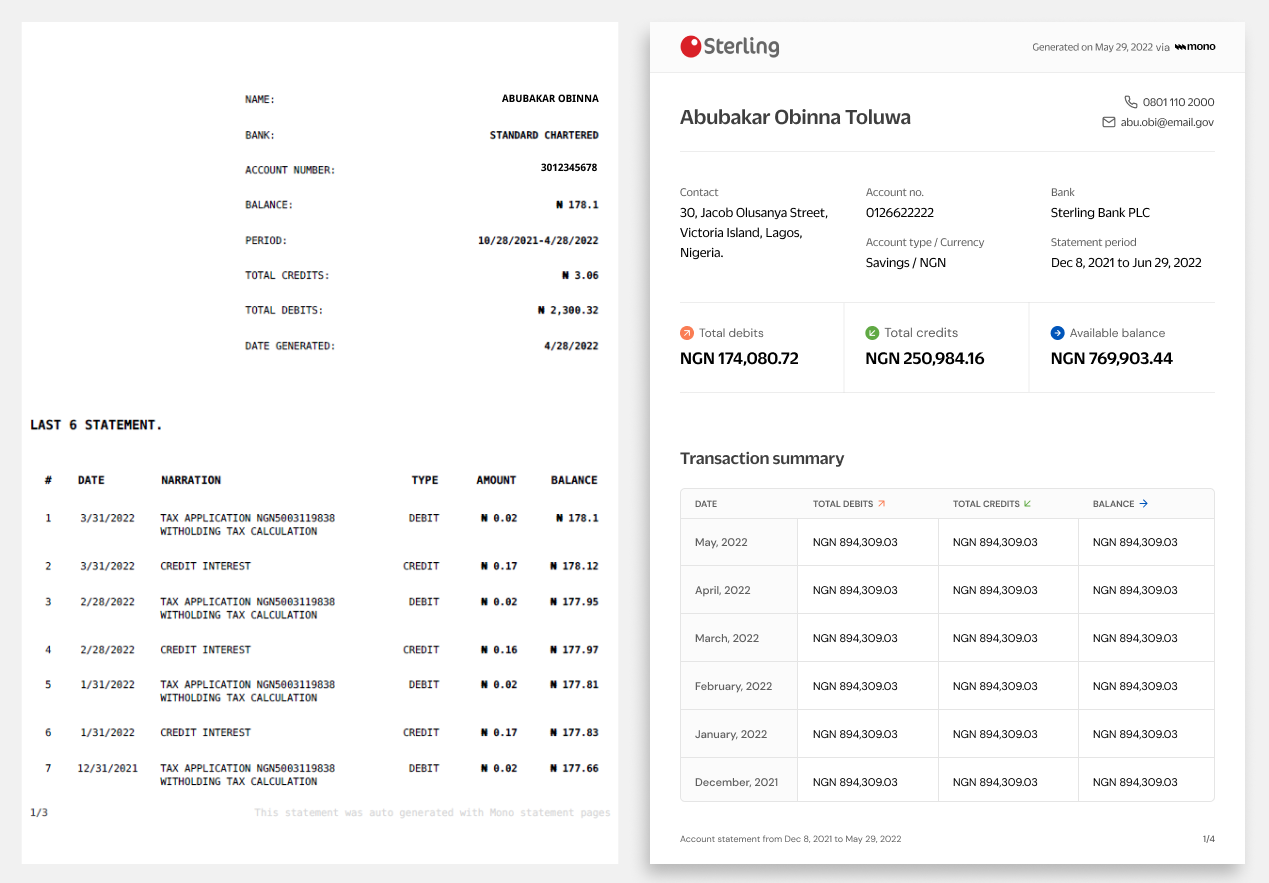

Today, we’re excited to announce that we have redesigned the Mono-generated Statement in PDF format. We have added improvements to give you clearer insights into customers’ transactions and help you make informed credit decisions. With the feedback and insights shared by our partners, we redesigned the Mono-generated statement in PDF to make your experience with our Statements product more seamless.

What's new in this layout?

We made four notable improvements to Mono-generated Statements in PDF format:

Improved Statement header

With the new statement header interface, you can easily view which financial institution the user shared their statements from, along with details like their full name, contact address (if applicable to the originating financial account), email, phone number, account number, account type, currency, and the statement duration. These are displayed in an organized view and allow you to see a customer’s top-level financial information at a glance.

General statement summary

This section has been improved so you can easily view the available balance, total debits, and total credits made on a customer’s financial account within the statement duration. This view of customers’ transactions helps you make sense of their transaction data quickly and speeds up your decision-making process.

Monthly Transaction summary

Before now, statements generated for multiple months were itemized in single transactions. Going through the statements in this order made it difficult to focus on certain periods of time. With the transaction summary section, statements generated for multiple months are now categorized into transaction volumes by month. For example, if you request a 6 months statement (January to June), you can now see a summary of transactions carried out in each of these months under total credits, total debits, and balance.Organized transaction view

With this improvement, we’ve made it easier to see customers’ transaction history in a single, organized view. Total transactions are organised in a separate section, making them clearer to view in rows and columns and data formats are written out in full to make it easier to understand transaction dates. In this section, you can also view the total debits or credits made, the available balance, and transaction narration for each transaction.

How to access the new layout for Mono-generated statements in PDF

If you’ve called the Statement endpoint or created a Statement Page to collect bank statements from your customers, you can access this improved PDF layout the same way. Simply click the view button next to any financial statement and download in PDF format.

If you’ve called the Statement endpoint or created a Statement Page to collect bank statements from your customers, you can access this improved PDF layout the same way. Simply click the view button next to any financial statement and download in PDF format.

For new customers

If you are new to Mono and yet to integrate the Statement product, all you need to do is:

- Sign up on Mono at mono.co/signup

- Follow our documentation to integrate the Mono Connect API into your service.

- Then, call the statement endpoint or create a statement page to securely collect statements from your users.

Questions you might have and answers to them

Can all partners access this feature on the Mono dashboard?

Yes, the new Statement PDF layout is available to all partners on the dashboard if you have successfully integrated our Statements endpoint and collected financial statements from your users.Is the new Statement PDF layout a paid feature?

We do not charge a separate fee to receive generated statements in the new PDF format. Once you have funded your wallet to securely collect statements from your customers, you can access them in the PDF (or JSON) format for free.

If you have any questions or feedback about the Statement PDF layout you’d like to share, please send us an email at support@mono.co — we'd love to hear from you!